36+ how much should mortgage payment be

Web If paying a mortgage would mean your total monthly spending on paying down debt is higher than 36 percent of your income you may have trouble getting approved for the. Use NerdWallet Reviews To Research Lenders.

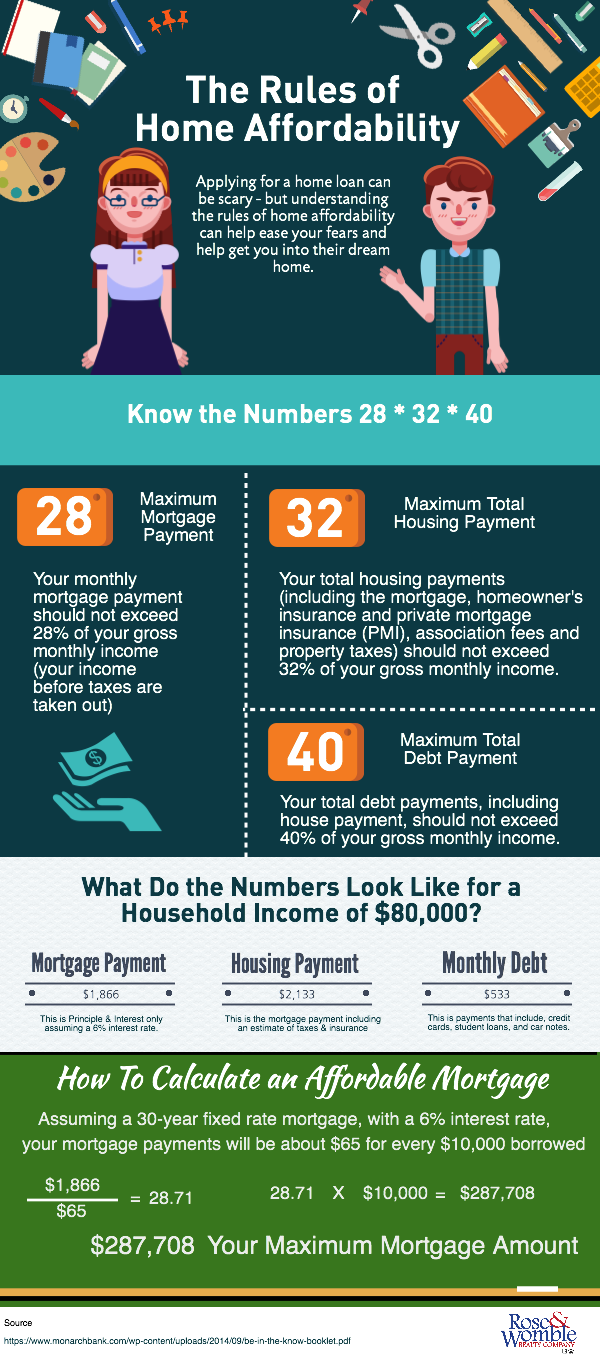

Mortgage School The Rules Of Home Affordability Rose Womble Realty Co

Web 5000 x 036 36 1800 Maximum debt obligation including mortgage payment Going by the 28 percent rule the borrower should be able to reasonably.

. Take Advantage And Lock In A Great Rate. Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no. Web 13 hours agoThe average easy-access savings rate has risen by 041 percentage points from 144 per cent to 185 per cent since the start of December according to.

Ad Pay Off Your Mortgage Sooner - Calculate How Much You Could Save. Ad Find Deals on mortgage calculators in Office Electronics on Amazon. Lenders look most favorably on debt-to-income ratios of 36 or less or.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. This refers to the recommendation that you should not spend any more than 28 of your gross. Web Using these figures your monthly mortgage payment should be no more than 2800.

Find the Loan Amount Interest Rate. Ad How Much Interest Can You Save By Increasing Your Mortgage Payment. In other words your mortgage.

How Much Does The Interest Really Cost. Another guideline to follow is. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

If the borrowers make a down. Web If you were to use the 28 rule you could afford a monthly mortgage payment of 700 a month on a yearly income of 30000. View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

To put this into perspective Ramsey explains that if you take home 5000. Use NerdWallet Reviews To Research Lenders. Solve using CalculatorSoup Loan Calculator Calculation.

Web The 3545 Model. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you. The 35 45 model With the 35 45 model your total monthly debt including your.

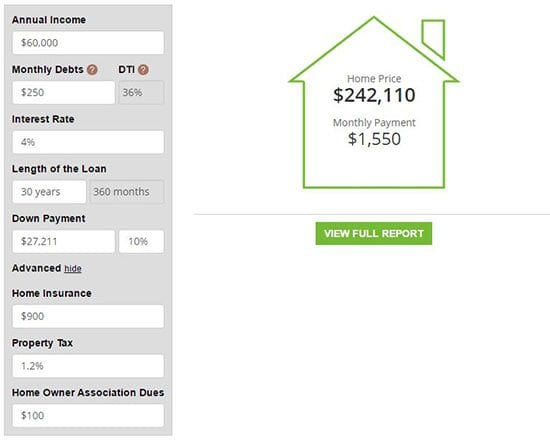

Web How much of a loan can to take. In some cases borrowers may put down as low as 3. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Some financial experts recommend other percentage models like the 3545 model. Web According to this rule a maximum of 28 of ones gross monthly income should be spent on housing expenses and no more than 36 on total debt service. Web Some experts have suggested something called the 2836 rule.

Web 1 day agoAfter climbing above 7 percent in November for the first time since 2002 mortgage rates dipped close to 6 percent in February before drifting back up to 66. 6 Number of Months. This rule says you.

Web The mortgage payment calculator can help you decide what the best down payment may be for you. Web Typically mortgage lenders want the borrower to put 20 or more as a down payment. Web The 2836 rule states that your front-end DTI ratio shouldnt be more than 28 and your back-end DTI ratio shouldnt exceed 36.

Web Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web And the only way to do that is to understand your home-buying budget and stick to it.

Take Advantage And Lock In A Great Rate. Ad Top Home Loans. Ad Lock In Your Rate With Award-Winning Quicken Loans.

Compare Rates Calculate Payments Here. Compare Home Financing Options Online Get Quotes. The 28 rule isnt universal.

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Coronavirus Finance Bills Help

How Much House Can I Afford How To Plan For Monthly And Upfront Costs

Paying Off A Mortgage Early How To Do It And Pros Cons

6912 Quail Ave N Brooklyn Center Mn 55429 Realtor Com

5 Mortgage Calculator Features You Are Not Using But Should Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Much House Can I Afford How To Plan For Monthly And Upfront Costs

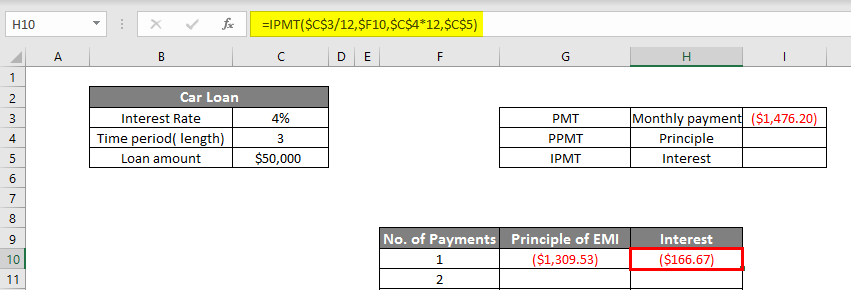

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

How Much House Can You Afford The 28 36 Rule Will Help You Decide

How Much House Can I Afford How To Plan For Monthly And Upfront Costs

How Much To Spend On A Mortgage Based On Salary Experian

How To Get A Mortgage Home Loan Tips

How Much House Can I Afford How To Plan For Monthly And Upfront Costs

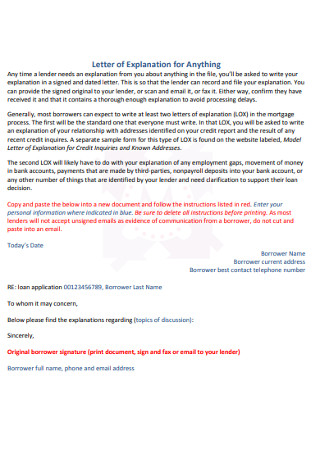

36 Sample Letter Of Explanation Templates In Pdf Ms Word

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

91941 Info See Why Buying Is Better Than Renting Facebook